提一提大家, 本年度6/4/2022-5/4/2023英國報稅的期限是31 Oct 2023 (紙本繳交) 及31 Jan 2024 (電子繳交) . 因申請UTR 需時, 要趕緊準備, 避免不必要罰款.

PS: 如需進一步查詢,請Wtsapp使用者名稱 Or FB加入「港英稅務」找我再詳談,謝謝

請問填foreign income, 係咪可以online填?

喺香港嘅儲蓄保險去咗英國一年之後到期拎番

咁使唔使報英國稅?

請問:

- 香港居民,在英國戶口做了定期,有利息收入,但好少。明白沒有千幾磅的免稅額,咁要做self assessment, 報稅嗎?

- 如退休後,到英國後收到每月的退休金,如在香港已交稅,還要在英國報稅嗎?

這個不是可以簡單得出答案的, 需要清楚保險條款及內容等, 你可以參考下HMRC guidiance HS321 而大概得出答案.

PS: 如需進一步查詢,請Wtsapp使用者名稱 Or FB加入「港英稅務」找我再詳談,謝謝

是, 可以填SA106 Foreign的表格.

PS: 如需進一步查詢,請Wtsapp使用者名稱 Or FB加入「港英稅務」找我再詳談,謝謝

-

如無其他收入 及利息收入低過1000 鎊, 可以不用填Self assessment.

-

根據英國及香港雙邊稅務協定, 香港退休金是香港以往工作得來的是不用交英國稅的.

PS: 如需進一步查詢,請Wtsapp使用者名稱 Or FB加入「港英稅務」找我再詳談,謝謝

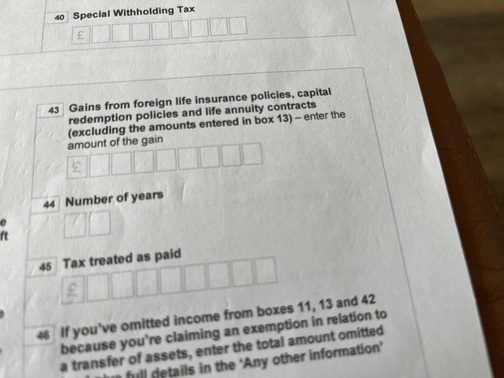

吾該晒, 請問多一樣野, 報foreign income SA106, 關於Insurance果part, Box 44 Number of Years 係咩意思? 個保險買多幾多年, 還是refer幾多年既gain?

你好, Box 43-45 請根據下列指引填:

Boxes 43 to 45 Gains on foreign life insurance

policies, life annuities and capital redemption

policies and life annuity contracts

Use the details on your ‘chargeable event

certificate’ to help you fill in boxes 43 to 45.

Do not include any amount you’ve already put

in box 13.

If you made gains from more than one foreign

policy, add them together and put the total

amount in box 43. Leave boxes 44 and 45 blank.

Provide the following details in the ‘Any other

information’ box on page TR 7 of your tax return:

• details of each individual policy

• the amount of gain for each policy

• the relevant ‘number of years’ for each gain, as

specified on the chargeable event certificate

• tax treated as paid on each gain

You’ll need Helpsheet 321 ‘Gains on foreign

life insurance policies’ to help you fill in boxes 43

to 45 if you:

• did not receive a certificate from your insurer

• own the policy jointly with someone else

(only include your share of the gain)

• have a ‘cluster’ of policies with the same insurer

and one or more has specific terms

• have been a non-UK resident during the period

you’ve been a beneficial owner of the policy

• paid more than £100,000 a year into the

policy or policies and you received a rebate

of commission or you reinvested commission

in the policy as additional premium

• consider that the gain is wholly disproportionate

and you wish to apply to HMRC to have the

gain recalculated.

PS: 如需進一步查詢,請Wtsapp使用者名稱 Or FB加入「港英稅務」找我再詳談,謝謝

你好,想請問,我哋一家在2022年7月嚟到英國,咁7月之前係香港個收入係咪一定要申請split year treatment 去處理?

係,如果想界開香港入境前收入 及英國入境後收入. Split year treatment 係最好通知HMRC的方法.

PS: 如需進一步查詢,請Wtsapp使用者名稱 Or FB加入「港英稅務」找我再詳談,謝謝

如果用online 報稅、係咪唔駛理5/10 deadline?

5/10 係申請6/4/2022-5/4/2023 的Self assessment deadline. 如本身有Self assessment 係手, 紙本交Self assessment deadline 係31/10/2023, 電子交Self assessment deadline 係31/1/2024.

PS: 如需進一步查詢,請Wtsapp使用者名稱 Or FB加入「港英稅務」找我再詳談,謝謝

想請教點為之申請?一直未收到UTR

5/10 前要申請.

PS: 如需進一步查詢,請Wtsapp使用者名稱 Or FB加入「港英稅務」找我再詳談,謝謝

請問而家喺英國有工作,用PAYE扣稅,另外香港儲蓄戶口有幾百蚊利息,需唔需要填self assessment? Thanks!

請問如果父母親人想過一筆錢俾我(比較大的數目),我需要申報或/和交稅嗎? 感謝!

Update - sent online request to HMRC to cancel my self assessment with the following reason:

“Just found out my HK income is only taxable in Hong Kong and should not be declared in the UK as payment for the employment is for work carried out solely in Hong Kong.”

The boldfaced statement was copied from a response made by a HMRC staff on a query from a Hongkonger.

HMRC has replied via mail and confirmed my self assessment is no longer required as he agreed with my reason.

PS. I’ve no UK income for year 2022-23.

不用, 額外收入超過1000鎊 先需要申請Self assessment.

PS: 如需進一步查詢,請Wtsapp使用者名稱 Or FB加入「港英稅務」找我再詳談,謝謝

There are no Income Tax implications on the receipt of a cash gift unless the cash gift generates interest or dividends. However, if this amount related to Inheritance Tax, it may be taxable.

PS: 如需進一步查詢,請Wtsapp使用者名稱 Or FB加入「港英稅務」找我再詳談,謝謝